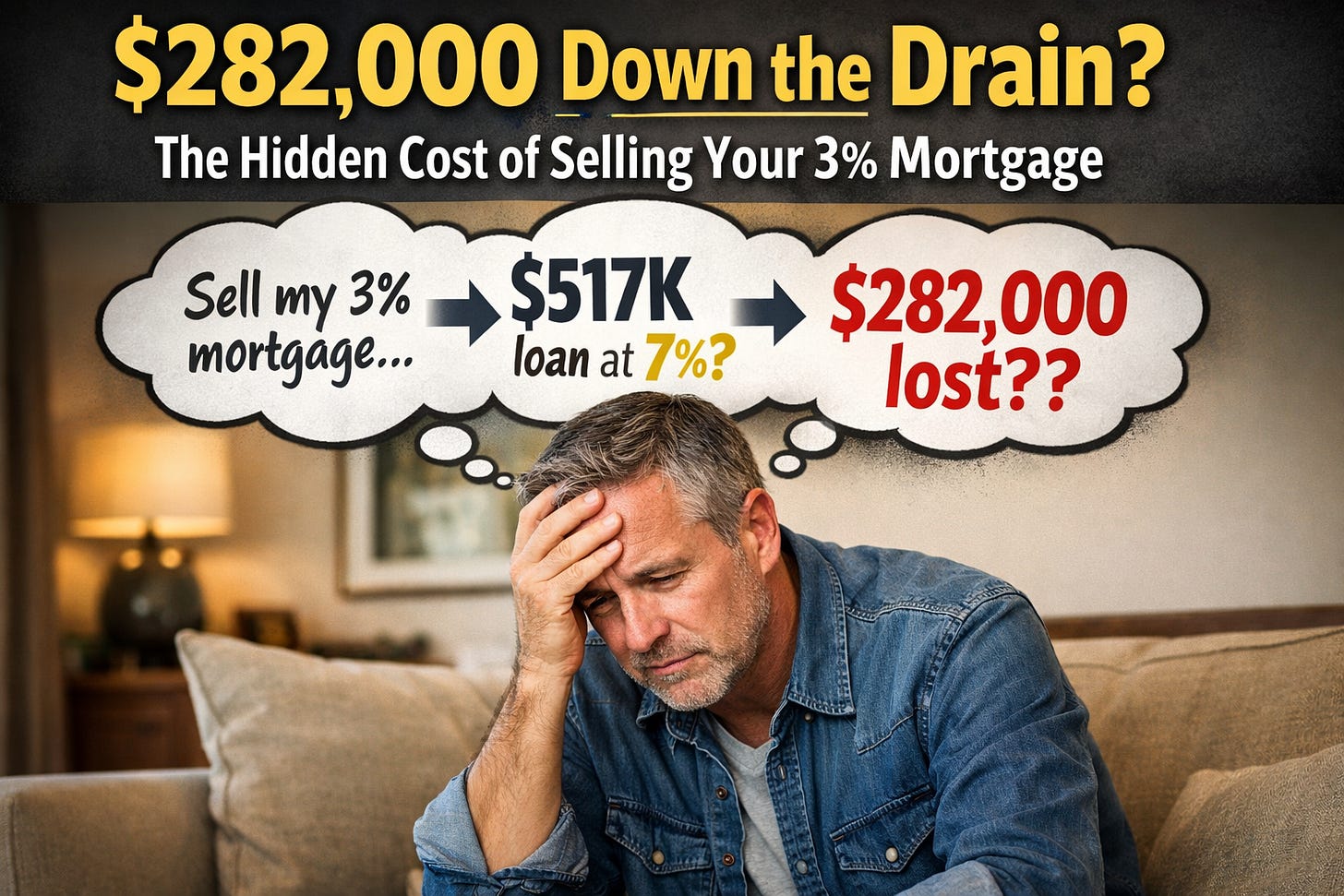

The $282,000 Ghost Asset Freezing the American Housing Market

How mortgage lock-in is destroying private wealth — and how residential defeasance could restart U.S. housing without stimulus.

The U.S. housing market is frozen not by prices, but by mortgage lock-in. Millions of homeowners are financially trapped by sub-4% mortgages, unable to move without forfeiting hundreds of thousands of dollars in purchasing power. This MacroMashup deep dive introduces residential defeasance — a long-standing commercial real estate tool — as a potential solution to unlock “ghost assets,” restore labor mobility, flood the market with inventory, and recapitalize the American middle class without rate cuts or taxpayer stimulus.

Welcome to MacroMashup — where we go past headlines and into the mechanics driving markets, policy, and capital flows.

If you care about why the economy behaves the way it does — not just what happened this week — you’re in the right place.

This week’s deep dive is exactly the kind of structural analysis MacroMashup is built for.

Subscribers receive:

• Weekly premium macro deep dives

• Structural frameworks for policy and capital shifts

• Early identification of second-order investment winners

• Clear explanations of complex financial plumbing

The economy is changing fastest in the places few people understand.

Before we get to housing, let’s take a quick look at where we ended 2025.

2025 Macro Recap: Systems Over Narratives

The final numbers for 2025 are in, and the message is clear: Embrace systems and hard analysis; save the headlines for entertainment. This year proved that market narratives are often just noise designed to distract you from the structural trends that move the needle.

The “Bear Porn” Fallacy

If you succumbed to the “recession is imminent” bear porn narratives in April and stayed on the sidelines, you missed another solid year for equities. The S&P 500 delivered a 16.4% return, marking a rare “hat-trick” of three consecutive years with near-20% or better returns (24.2% in 2023 and 23.3% in 2024). Meanwhile, the tech-heavy NDX outpaced it with a 20.5% gain.

Hard Assets, Hard Data

Those who ignored the macro implications of persistent deficits and geopolitical friction missed a historic uptrend in precious metals. Silver was the champion of 2025, skyrocketing ~144%, while Gold finished up 65%—its strongest annual performance in decades. These weren’t speculative bets; they were systematic responses to a structural supply-demand imbalance and a global “debasement trade”.

The Bitcoin Reality Check

Finally, if you believed the narrative that 2025 was the year Bitcoin would accelerate into a new dimension, the charts taught you a difficult lesson. Despite a brief, high-octane run to all-time highs near $126,000 in October, the leading digital asset decoupled from the “everything rally” to end the year with a 6.4% decline. This highlights the danger of relying on “digital gold” narratives when the system itself—liquidity, leverage, and positioning—signals a different path.

What’s Going on with Housing?

The U.S. housing market looks strangely resilient.

Prices are still high.

Mortgage defaults are low.

Homeowners appear “wealthy” on paper.

And yet… almost nobody is moving.

This is usually explained as an affordability problem or blamed on “higher rates.” That explanation is convenient — and wrong.

What’s actually happening is more uncomfortable:

The American housing market is frozen because moving destroys private wealth.

Not a little.

Six figures.

Hidden inside millions of sub-4% mortgages is a financial asset most homeowners don’t know they own — and the moment they sell their home, that asset vanishes.

That disappearing value doesn’t show up in GDP.

It doesn’t show up in housing statistics.

But it quietly dictates behavior.

People stay put.

Jobs go unfilled.

Inventory dries up.

And policymakers keep pushing the wrong levers.

Here’s the contrarian part:

The housing crisis is not about prices, supply, or demand.

It’s about the forced destruction of a valuable financial contract.

This week on MacroMashup, we explore a question almost no one is asking:

What if a mortgage isn’t just debt — but an asset?

And what if the solution to the housing freeze already exists, hidden in plain sight, quietly used by professionals — just not households?

What We’re Diving Into This Week

This is where the overview ends — and the real work begins.

In the second half of this piece, we break down:

• Why millions of homeowners are sitting on a six-figure “ghost asset”

• The math behind why selling destroys purchasing power

• How commercial real estate already handles this problem

• Why lenders might actually prefer an alternative structure

• How this could restart housing mobility without stimulus or rate cuts

• Why this reframes the entire housing-policy debate

This isn’t a housing take.

It’s a capital-plumbing problem hiding inside plain English.

If you want the full argument — and the mechanics behind it — this is where you continue.

👉 Upgrade to keep reading.